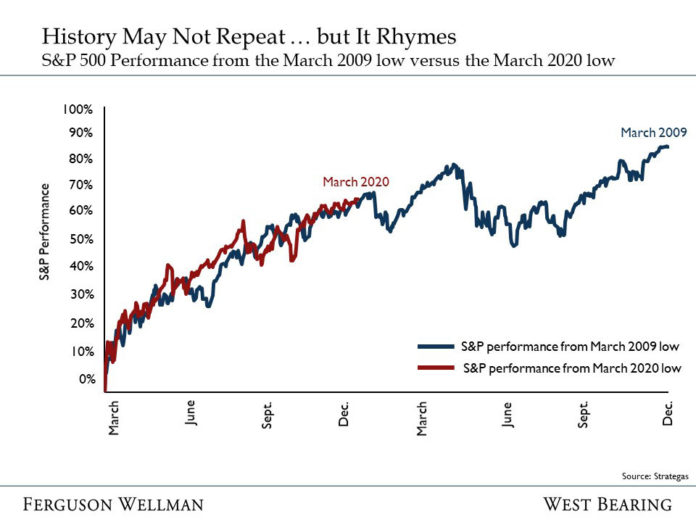

Like Michael J. Fox’s character in the memorable 1985 movie classic, investors today are experiencing a return to playbooks of times past that many deemed improbable following the unprecedented events of 2020. Stocks that fell victim to the COVID-19 bear market last March mounted a furious comeback that would proceed to erase the losses and generate 18% returns on the S&P 500 last year. Though excesses in housing responsible for the global financial crisis were completely different than proliferation of a deadly virus that precipitated last year’s deepest and shortest recession on record, the result for dispassionate equity markets is much the same.

Whether recent volatility predates an imminent stock market correction remains to be seen, but pullbacks are inevitable, and they are a healthy part of any new bull market. With a surfeit of ongoing fiscal and monetary stimulus in play now being augmented by global vaccinations promising to move us past COVID-19 restrictions later this year, an equity market correction at this point of the economic cycle should prove to be a buying opportunity.

More than half the U.S. jobs lost last year have already been recovered. Americans have adjusted to a socially distanced lifestyle by placing a premium on e-commerce and housing, while prioritizing “stuff” over experiences. Accordingly, companies like Amazon.com and a multitude of homebuilders and home improvement retailers have picked up the slack, helping heal a labor market badly scarred by the pandemic lockdowns.

Retail sales have eclipsed pre-pandemic levels and housing is booming thanks to record-low mortgage rates. Although the heart-wrenching toll of COVID-19 persists for now, distribution of vaccines is ramping up and investors are now discounting a renewal of life as we know it in 2021. Those unemployed by the most directly impacted industries should see jobs regained as people return to the air for business and leisure travel, boosting the airlines and associated hotels, as well as restaurants that also stand to gain from the renewal of everyday, on-premise dining.

Although we anticipate continued improvement, above-average levels of unemployment are likely to keep today’s below-targeted levels of inflation from rising excessively in 2021. In the presence of ongoing quantitative easing and zero interest rate policy from the Fed, we see long-term interest rates rising only modestly this year.

Politics are a concern to many following the contentious elections recently concluded. Will additional fiscal stimulus pass Congress? If so, how much? Are taxes going up? What about the market implications of a democratically controlled Congress and presidency? Stocks have risen over time regardless of which party holds power, including the present state of affairs.

With the Senate split 50-50 and a reduced majority of democrats in the House of Representatives, legislative policy is unlikely to stray too far from the center. For example, additional fiscal stimulus is likely to be less than the controlling party’s ask. Meanwhile, taxes are likely to rise for both corporations and high-income earners, but probably not until next year. More importantly, tax rates are likely to rise only modestly because a new administration will want to avoid overturning the apple cart of economic recovery.

As aggregate demand more fully recovers, corporate earnings should continue to rebound, providing a consequential tailwind for stocks. Against this backdrop of early economic recovery, we remain overweight equities and their more cyclical constituents in the consumer discretionary and industrials sectors.

While bonds provide ongoing insurance against unexpected economic weakness, their expected rates of return have become less attractive in a low-rate environment. Accordingly, we remain underweight the asset class. In addition to dividend paying

equities, “alternative” investments in real estate, infrastructure and cropland will be employed to an increasing extent as we position client portfolios to generate the type of income and returns now absent from fixed income markets.

Shawn Narancich, CFA, is executive vice president, Equity Research and Portfolio Management, with Ferguson Wellman Capital Management. Contact Ferguson Wellman at info@fergwell.com.