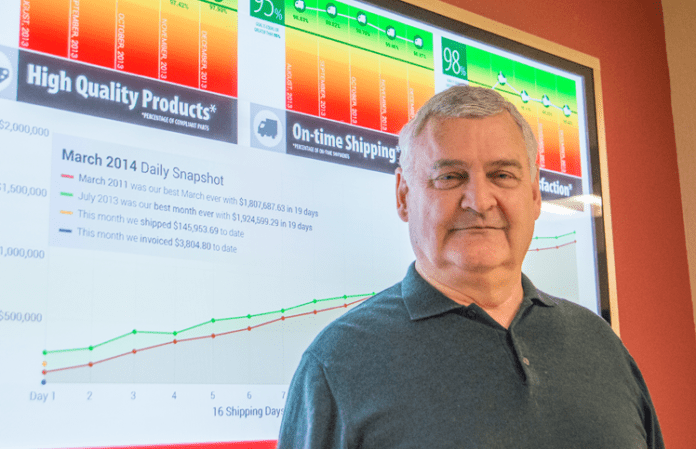

“There is a better return on investment to invest in our own company than if you put the money into the stock market or somewhere else,” said Bob Willoughby, president of US Digital, a Vancouver-based manufacturer that prides itself on operating debt-free.

Whether out of choice or need, small and medium-sized businesses have been increasingly following suit. After the real estate crisis and subsequent recession, banks began tightening their reins on lending and the resulting trend has left businesses looking inward for creative self-funding options, and banks now competing over low loan demand.

“We’ve seen a trend toward a lot more businesses self-funding because of the situation of the banks over the last several years,” said Buck Heidrick, Certified Business Advisor for Vancouver’s Small Businesses Development Center (SBDC).

To Heidrick, who has been in the business-consulting world for 20 years, the trend is clear. As banks curtailed conventional loans due to growing risk aversion resulting from the recession, small businesses had no choice but to pursue other avenues for short and long-term growth.

According to Richard Michalek, chief lending officer for Riverview Community Bank, the recession caused a decrease in loan demand too, particularly in Clark County.

“We were pretty leveraged in the real estate industry,” he said. “Loan demand went down so the land loans [and] builder loans dried up. Banks were trying to unload a lot of their own inventory that they’d accumulated from taking back loans.”

The perfect storm led companies to untraditional outlets to fund growing ventures.

“People turned to the three F’s,” Heidrick said. “Friends, family and fools.”

Heidrick cites that historically, and even more so due to the recession, banks don’t tend to lend as much to fledgling start-ups “without assets or a history of performance.” And some small businesses have had more than just an unproven reputation to overcome.

Mary Jane’s House of Glass, which has been in the smoking supplies business since 2000, has long had to use untraditional funding due to its industry.

“The banks wouldn’t even lend to us to buy a commercial property,” said Bobby Saberi, partner and operations manager. “Because of the industry that we’re in, we’ve had to take the time to invent other ways to save and reinvest in order to meet the growing demand.”

Mary Jane’s plans to open four new stores this year, which will make a total of 15 stores, and was recently named Fastest Growing Company (10+ Years) in the Vancouver Business Journal’s 2015 Business Growth Awards.

“We are a family-run business and have always taken from our monthly profits to reinvest in future growth,” said Saberi. “We also take on funding from individuals who want to have ownership, almost like a franchise model.”

Saberi and his team have what they call a “proven model” in which individuals purchase a location, come up with the funding and make themselves a partner in the store. Both parties share in any net profit or loss.

Getting creative is an essential part of non-traditional funding. Whether it is developing a proven business model, internal cost-cutting or special agreements with suppliers within the production chain, Heidrick explained that there are many benefits to internally funding. One primary benefit is avoiding “debt service,” which is essentially interest paid on borrowed money.

“That interest isn’t buying anything except the use of that money,” he explained. “That’s money that, if you can figure out how to find it internally, you can keep and use for something that will help your business goals.”

Successful internal funding doesn’t always mean relying on the founders and associated groups.

“No friends and family,” laughed US Digital’s Bob Willoughby. “This is all cash generated by the company that we reinvest directly back in.”

Businesses like US Digital use profits to do exactly the same things loans permit other companies to do: hire new employees, purchase equipment, ramp up orders, innovate and develop future products, and more. Willoughby said that this strategy has never hindered US Digital and there’s never been a situation where internal funds couldn’t be used to expand and reach the company’s goals.

Of course, there are benefits to traditional funding as well. Heidrick discussed that having credit can help build a company’s track record.

“It’s not always a bad thing to have credit,” he said. “If your business is healthy and you have credit, you can have access to cash instantaneously.”

Heidrick sees this trend toward self-funding as a potential threat to the banking industry because “to a degree, the banks are now competing with their former customers.”

And there certainly are markedly fewer small businesses seeking loans than before the crisis. Be it because companies are looking internally or because they have accumulated surplus cash on their balance sheets, banks that are ready to lend have found themselves competing with other banks over the diminished amount of businesses in the market for loans.

“It’s a competitive world out there for commercial lending, because most banks want that type of lending now,” Riverview’s Michalek said. “A lot of banks around here are chasing the same demand, the exact same client.”

Though interest rates are at their lowest in years, some small businesses don’t see a reason to use debt service to fund growth.

“Even with the low cost of money today,” Willoughby said, “it just doesn’t make any sense for us to borrow to invest rather than use our own money to do it.”